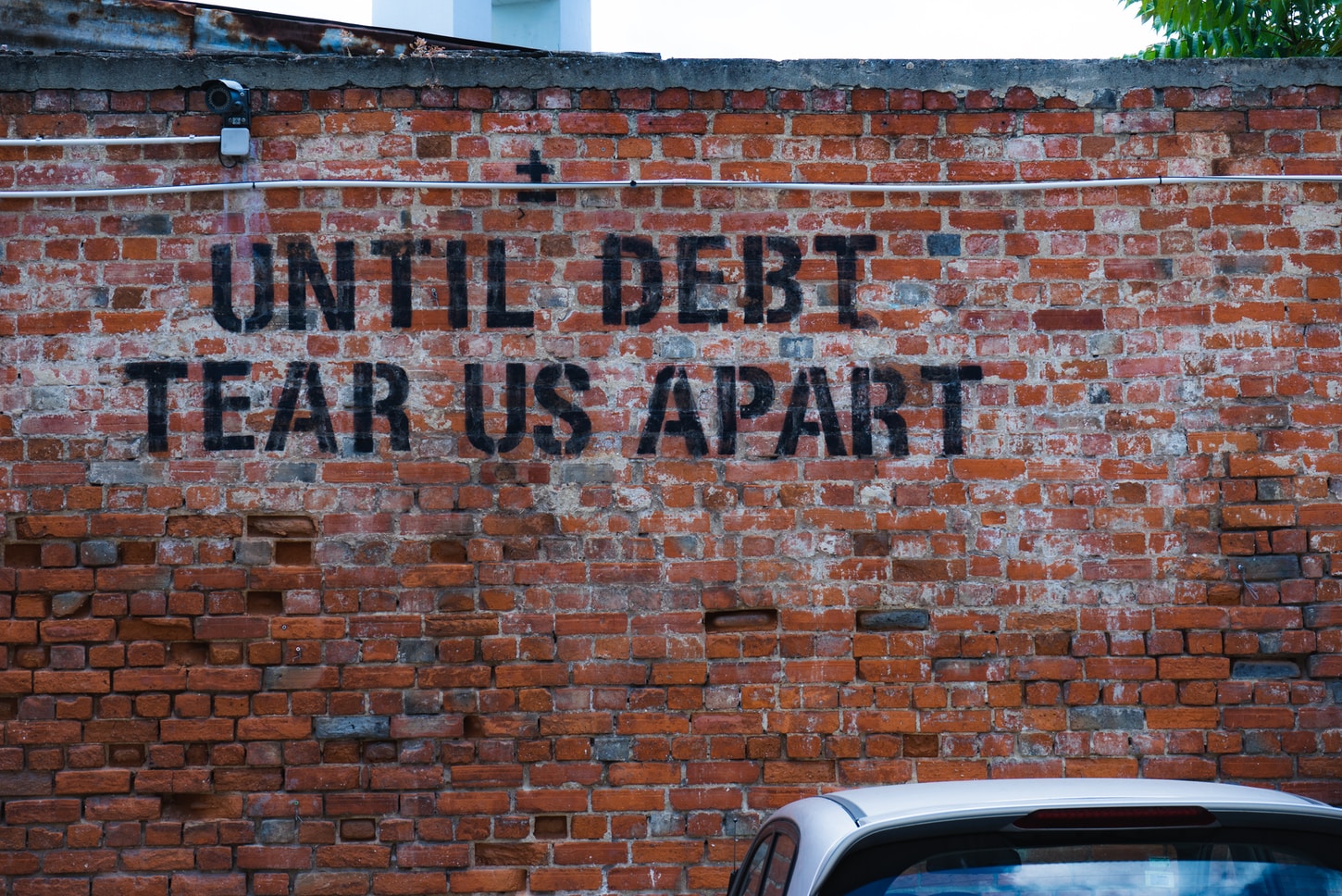

We live in a time when most everyone has some level of debt, whether it be student loans, credit card, auto, home, medical, etc. The big question is, can you get a divorce with debt…the short answer is ‘yes’; however, you should be aware of a few key factors that come into play when debt is part of your settlement.

As you enter divorce negotiations it is important to disclose all your marital debt and most importantly to understand who “owns” or whose name is listed on the debt. As you split debt, one key post-divorce task should be to ensure that you and your spouse remove each other from the debt the other will carry forward. A lender does not care that a divorce has taken place. If your name is on a loan that your ex-spouse is not paying, then creditors can and will come after you, and it will affect your credit as well.

There are situations, especially with the primary home, where one spouse may be unable to qualify to refinance the home. If your name is remaining on the primary home, but you will no longer have access to that asset, you want to be sure that safeguards are put in place within your divorce decree that offer protection for you in the event your ex-spouse is unable to pay the mortgage. Working with a financial neutral, like a Certified Divorce Financial Analyst at Next Step Divorce Solutions, can help guide you and your spouse to develop a creative settlement solution that would address these types of situations.

If possible, it best to begin a post-divorce life debt free. From the onset that may seem impossible but with the right creative solutions that could be a reality. There are some assets that waive tax penalties if transferred in a divorce. An example are transfers made within a Qualified Domestic Relations Order (QDRO). You are allowed a onetime withdrawal from a 401k or other ERISA plan, penalty free before 59 ½, if that asset is transferred by a QDRO. Another possible example we often don’t consider is utilizing the equity in the home. It is not uncommon that what is often the two largest assets in a divorce, retirement plans and home equity, are considered locked up, but in the case of divorce those assets could become accessible.

Divorcing with debt is possible, and with a Certified Divorce Financial Analyst on your team we can help you to navigate the potential pitfalls and payoff solutions in your divorce settlement.

Kneetly

PMID 29899523 Free PMC article cialis for sale in usa

https://Reactoonzz.com

Great online game https://Reactoonzz.com/ where you can make money, buy yourself a new phone or a car, close the mortgage on your apartment and only one month, quick to register and win.

Anonymous

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/ur/register?ref=IJFGOAID

nejlepsí binance referencní kód

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/cs/register?ref=PORL8W0Z

binance Препоръчителство

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Casino Affiliate Programs Review

Good ranking of Casino Affiliate Programs Review casino and sports betting affiliate programs, Super affiliate programs only with us, review, rating

Log in

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you. https://www.gate.io/zh/signup/XwNAU

Gaza and its Resistance to Israel's Brutal Attacks

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

To tài khon min phí

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/vi/register-person?ref=53551167

dubai horse racing live

This is my first time pay a quick visit at here and i am really happy to read everthing at one place . dubai one tv live online free

Binance referal code

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/ph/register?ref=GJY4VW8W

Регистрация на binance

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/ru/join?ref=53551167

Live TV

Greetings! Very helpful advice in this particular article!<a href="https://www.images.google.com.sg/url?sa=t

hot deals

Very well presented.very quote was awesome and thanks for sharing the content.Cat Brushes for Indoor Cats Dog Brush for Shedding with Metal Comb Self Cleaning Pet Hair Brush with Release Button for Grooming Kitten(Grey) – Hot Deals

hey dudes for girls

You’re so awesome! I don’t believe I have read a single thing like that before. – hey dudes near me

Anonymous

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/sk/join?ref=PORL8W0Z

Λογαριασμ Binance

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/el/register?ref=VDVEQ78S

Anonymous

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.