Divorce Mediation: What you Should Know

Most people facing a day in court would avoid it if they could. When facing divorce, that urge is just as strong. If you are considering divorce you need to also consider HOW you want to go through your divorce and know that you do have options. The first option you may want to consider is mediation. For the remainder of this article, I will be focusing on private mediation, likely with a non-attorney mediator, outside the litigated process. Using the private mediation process helps you and your partner reach a mutually beneficial divorce settlement.

So, Why Mediation?

Besides the whole, court avoidance thing, if you have children, jointly owned real estate, and investments, mediation may be the wisest option for you. Once you have decided on a divorce, the next step is to decide how to split up your assets and set child custody, support, and visitation rights. A mediator is an impartial third party that guides a couple in the negotiations preceding the actual divorce.

Unraveling your marital ties is a very emotional thing in addition to the trust issues and hurts. During this time, many of us find it hard to stay rational, and a mediator can help you both reach the point where you can agree and compromise on important decisions. While a mediator can’t give legal advice, they can teach you to communicate more efficiently. In a situation where you both desire to reach an amicable agreement and can stand to be in the same room, mediation may be the right choice for you. You can even conduct mediation over the phone or video conference if needed.

Mediator, Take the Wheel?

If you do choose mediation as an alternative, you still need to be prepared. Divorce court is not a place to fly by the seat of your pants. Neither is the divorce mediation. It still comes with much of the stressful procedures of a typical case. And if you go in unprepared, you may lose out on the settlement that you desire.

Mediators only work with you and your partner to settle the important decisions a divorce forces you to make. They will not tell you what you should do. Nor will they make decisions for you. So, think about what you want your life to look like when this process is done. And focus on what you need from the separation to get there.

Meeting with Your Divorce Mediator

When you go to your first meeting with your divorce mediator, bring a list of all your jointly owned assets, a valuation of your home, copy of a prenuptial agreement if you have one, copies of income tax returns, and retirement account statements. Take a notebook and pen and don’t be shy about asking questions.

Write down everything you need to remember and talk about fees. This is where having a financial expert like a CDFA® becomes paramount to the mediation process. The first meeting with a divorce mediator will be to assess your situation, get a feel for the chemistry between the couple, and to get to know the mediator. Keep in mind that not all mediators are created equal; you want to work with a mediator who has a good understanding of divorce issues and some legal understanding. That first meeting may be done together or individually.

Although the mediation is held in an office or meeting room, it should still feel like an informal atmosphere. The mediator strives to create a relaxed situation so that both partners can remain calm. One of the main goals of the mediator is to help the couple find creative ways to communicate and reach an agreement. Especially if strife does exist between the couple. There’s no set frequency for a session because every divorce is unique. Some couples find they only need a few sessions, while others may need more.

Choosing mediation doesn’t necessarily mean not choosing to work with an attorney. It is important that you understand your legal rights throughout the divorce process. Some attorneys may be able to give some guidance through just consulting without having to formally retain their services. Mediation is not for everyone, but it does serve many. Ultimately, being able to avoid court will make for a better day for the whole family.

For more information or questions please contact Next Step Divorce Solutions.

How Your Divorce Could Financially Impact Your Child with Special Needs

There are important considerations that must be made if you have a child, or children, with special needs and are considering a divorce. Divorce is difficult but adding the complexities of a divorce when a child with special needs is involved can be overwhelming and even debilitating. There are so many details that require special attention that it can be difficult to know where to start. Caring for a special needs child without the complexities of divorce is challenging enough. I have personally watched my parents try to navigate and understand the government rules and regulations surrounding benefits my brother could or couldn’t qualify for at varying stages of his life. Now as they begin to walk through the transition to retirement and what that means for my brother’s assistance, like Medicaid to Medicare and how that may or may not affect other assistance from local agencies is overwhelming.

If you are heading down the path of divorce and you have a child or children with special needs, it is imperative that you gather the right team around you to move through this process. Typical divorce challenges, like child support, determining a co-parenting plan and the financial settlement all have additional layers of complexity to consider. If your child will be unable to emancipate then the typical short-term decisions become lifelong decisions.

There are irreversible financial implications of divorce that if not done correctly could cause a child to completely lose government assistance programs, like Medicaid or SSI. If you are getting a divorce and a have a child with special needs you want to include professionals like a family law attorney, an estate attorney who specializes in special needs trusts and guardianship, and a Certified Divorce Financial Analyst who understands the financial intricacies of planning for a child with special needs.

I understand how impossible it can seem to find the right resources or guidance to navigate the world of government assistance programs or even put thought to tomorrows challenges. Unlike a Certified Divorce Financial Analysts, attorneys are often limited to a specific geographical area where they can practice. If your family is walking down this road do not limit yourself to receiving piecemeal information, add a CDFA to your team, either local or remote, to help guide you through all the facets of your divorce and planning for your child with special needs.

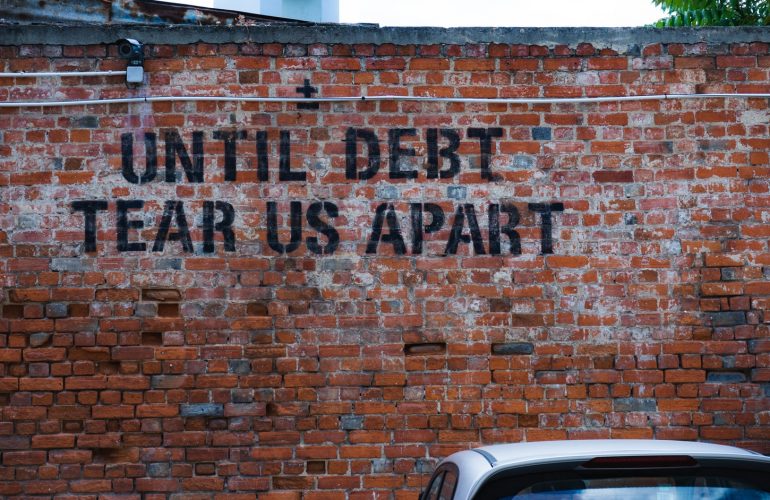

Can you Divorce with Debt?

We live in a time when most everyone has some level of debt, whether it be student loans, credit card, auto, home, medical, etc. The big question is, can you get a divorce with debt…the short answer is ‘yes’; however, you should be aware of a few key factors that come into play when debt is part of your settlement.

As you enter divorce negotiations it is important to disclose all your marital debt and most importantly to understand who “owns” or whose name is listed on the debt. As you split debt, one key post-divorce task should be to ensure that you and your spouse remove each other from the debt the other will carry forward. A lender does not care that a divorce has taken place. If your name is on a loan that your ex-spouse is not paying, then creditors can and will come after you, and it will affect your credit as well.

There are situations, especially with the primary home, where one spouse may be unable to qualify to refinance the home. If your name is remaining on the primary home, but you will no longer have access to that asset, you want to be sure that safeguards are put in place within your divorce decree that offer protection for you in the event your ex-spouse is unable to pay the mortgage. Working with a financial neutral, like a Certified Divorce Financial Analyst at Next Step Divorce Solutions, can help guide you and your spouse to develop a creative settlement solution that would address these types of situations.

If possible, it best to begin a post-divorce life debt free. From the onset that may seem impossible but with the right creative solutions that could be a reality. There are some assets that waive tax penalties if transferred in a divorce. An example are transfers made within a Qualified Domestic Relations Order (QDRO). You are allowed a onetime withdrawal from a 401k or other ERISA plan, penalty free before 59 ½, if that asset is transferred by a QDRO. Another possible example we often don’t consider is utilizing the equity in the home. It is not uncommon that what is often the two largest assets in a divorce, retirement plans and home equity, are considered locked up, but in the case of divorce those assets could become accessible.

Divorcing with debt is possible, and with a Certified Divorce Financial Analyst on your team we can help you to navigate the potential pitfalls and payoff solutions in your divorce settlement.

What to do After the Divorce

You made it. (Take a Breath…you deserve it) The divorce process can be long and grueling, and I am sure by now your ‘divorce brain’ is at its peak. So now what? You have been laser focused on completing this one task and now that it’s done you get to choose what happens next, BUT FIRST you want to make sure that you IMPLEMENT that divorce decree that you have worked so hard to finish. I know, I know it is probably the last thing you want to touch or deal with. Your idea of implementation is likely to make the changes to accounts you need access to right away and put the rest on the back burner to deal with later. Yes, take a break and allow yourself some time to relax from it all…but do not let a year roll by before you touch it again.

I encourage you to finish the end of this process and avoid dragging it out longer than necessary. I promise, attempting to implement months or years later is significantly more challenging. There are a handful of crucial things that should be done…and the best part is, your CDFA® can help you or put you in contact with the professionals that can.

Unless you and your spouse maintained separate finances, you are likely going to need to remove your ex-spouse from some bank and investment accounts. If you received a portion of your ex-spouse’s ERISA retirement plan that requires a Qualified Domestic Relations Order (QDRO) to split the asset, you DO NOT want to delay. These can take time and delaying may require additional legal steps to get the process started.

As you begin reviewing and re-registering your accounts, don’t forget to also review your beneficiary designations. Your IRA or 401k may only have your name on the account but at your passing that particular asset will transfer to whomever is listed as your beneficiary. Consider meeting with an estate attorney to update all your documents, they can also direct you on how best to update all beneficiary designations.

You may find yourself making financial decisions that you never made before. Ask questions and get guidance, it will take time to build confidence in handling your finances. The right financial advisor can help to educate and guide you through building your new financial future. Don’t be afraid to reach out for help and to learn, you are capable!

For more information or details on how to implement the pieces of your divorce contact Next Step Divorce Solutions today.

Keeping the House in the Divorce

It is common that throughout the divorce process someone will decide that they want to keep the family home. As a mother you may find that your inherent need to be the caregiver has shot you into fight mode to maintain some form of normalcy for your children. You may find yourself holding tight to the home you believe can provide that stability you know your children (and you) desperately need during this time. While it can be tempting to want to lean on something familiar you need to be cautious that it may also be the costliest mistake you could make. I know it sounds cliché, but a house is just a house, and over time your home will become wherever you are. The family home can hold a lot of emotion, good and bad. So first try to look at the house as just another asset to be divided.

There are a handful of factors that are at play when deciding what happens to the family house. In some cases, the financial affects may not be felt until years down the road, but can be costly, nonetheless.

Oftentimes the house is the largest asset in the divorce settlement. If you decide to keep the house, you may find your financial freedom locked up in the equity of that building. Let’s assume you have been in your house for a while and the market value is $400,000 with $300,000 in equity. As marital property you are entitled to half of that equity. So, if you were to keep that house, then the full $300,000 of your divorce settlement would be tied up in the property. If you were to take that same $300,000 and conservatively invest it, you could generate over $12,000 a year in income. And don’t forget about the costs of upkeep, maintenance, and for places like Texas, the high property tax. These items will require you to increase the amount of income needed just to make ends meet.

The factor that can come back at you down the road is taxes. If you were to sell the house while you were still married the $300,000 gain would fall under the marriage exclusion of $500,000 and be tax-free. However, if you were to sell the house after it has been transferred into your own name that gain is no longer fully covered under the reduced exemption of $250,000 for a single individual. Now you are looking at a gain of $50,000 that would cost at least $7,500 in capital gains taxes and even more if you’re a high wage earner.

Divorce is hard but it also can open the door to a new beginning, a new you. Starting on the right financial footing is essential to your future. To be certain that you understand all the ramifications of the property settlement you are considering, bring a Certified Divorce Financial Analyst® (CDFA®) into your team to guide you through some of these issues. You only have one chance to get your settlement right. Take the time to gather information and make sure you are doing the right thing. It will be the best decision you ever made.

Why Hire a Certified Divorce Financial Analyst®?

The Institute for Divorce Financial Analyst summarizes the role of the Certified Divorce Financial Analyst® (CDFA®) professional as someone that helps both the client and lawyer understand how the financial decisions made today will impact the client’s financial future, based on certain assumptions. In many cases the CDFA® professional already has an extensive financial background as a Certified Financial Planner® (CFP) or in accounting as a CPA.

That definition, although accurate, misses the most impactful service a CDFA® provides. You have heard “knowledge breeds confidence, confidence destroys fear”. When one of our loved ones becomes ill, our desire to help tends to drive us to research and learn everything we can about that illness. Right?!? Ultimately, we lean on the professionals who are well trained to help our loved ones, but the more we learn and understand brings a level of calm that minimizes the fear of the unknown. As we flip the equation to your divorce, consider the peace that more knowledge and understanding could bring to the situation. A CDFA® does more than help you determine the best financial course of action. They provide education about what you have and what it means to you, and ultimately guide you along the process to help you make the most informed decision about your settlement. That additional knowledge provides a new calm that otherwise would have you strapped in fear; fear of the unknown, fear of the future.

Your CDFA® professional is specifically trained to help you gain an understanding of your financial outlay and then in turn identify for you and your spouse the most equitable settlement options. In addition, they can then illustrate how those settlement options could impact each of your financial futures. It is expected that the role of the CDFA® professional would be to provide financial expertise for individuals engaged in the divorce process, but I believe the most overlooked advantage is their ability to minimize the impact of fear. They add a crucial factor that an attorney just cannot provide, financial clarity…for the now and the future. Minimize your fear by hiring a CDFA® to help guide you through your divorce.

What Kind of Divorce do you Want?

When you begin to consider divorce you need to know you have options. If you have made it to this point you, probably have exhausted your resources to try and save the marriage; but if not, I would encourage you to first seek out a family therapist/counselor.

Most people are familiar with the traditional avenue of divorce, I hire my attorney and they hire theirs, then we battle it out in court or separate mediation. This option is typically the most expensive, most lengthy, and I would even argue the most emotionally detrimental to all parties involved. In the state of Texas divorce cases can average six months to a year long and cost on average $15,000 to $30,000. Most people don’t realize there are alternatives to this solution.

The least expensive option is to file ‘pro se’ or file completely on your own. This is the full pendulum swing from a litigated or attorney driven mediation. There are however BIG dangers with choosing this option, without receiving any professional guidance HUGE mistakes could be made. Standardized forms may not be detailed enough to clearly detail your specific situation. You may choose a settlement that looks “fair” on paper but is anything but that at the end of the day.

Another option is to forgo an attorney and go directly to a mediator. This process is less costly but without proper guidance could still lead to some financial mistakes. If you choose this option, I would recommend having an attorney prepare your divorce papers from your ‘Statement of Understanding’. Your mediator should provide that document once you have come to an agreement with your spouse.

Then you have collaborative divorce. This process includes each spouse choosing a collaboratively trained attorney as a first step, and then other professionals to complete the team as necessary. The full team includes your attorney, a mental health professional, mediator (in many cases this is also your mental health professional), and a neutral financial expert. There are rules surrounding how this type of arrangement might work that have many pros and cons.

At the end of the day you want to finalize your divorce in the quickest, least painful way with as minimal financial expense as possible. My suggestion to you is under “normal” circumstances you should consider reaching out to a CDFA® or a Certified Divorce Financial Analyst® to help give you some guidance on which of these divorce processes might work best for you. Why a financial expert? One of the leading causes for divorce in the U.S. is financial issues. It’s not surprising that couples have ugly divorce wars when they are trying to agree on the one thing that they never could agree on before. So why would you not have a financial expert help you navigate the intricacies of splitting assets??? At Next Step Divorce Solutions, we offer an alternative solution to divorce that aims at saving you money and preserving your family relationships, if possible, by avoiding the war of divorce and offering a more respectful, streamlined process.

3 Secrets to a Successful Divorce

What is a successful divorce? For some that may mean getting most of the assets; for others it may just be completing the process as quick as possible. My desire for the individuals and couples I work with would be that both parties come out educated, with an understanding of what their divorce settlement means for their future, while still maintaining the family unit throughout the process. For that to be a reality there are a few secrets that you must know to achieve that successful divorce.

Secret #1 – Be Open to Mediate

No matter where you live divorce is expensive and the longer the process and more fighting you do, the costlier it becomes. Have you ever spoken with anyone who bragged about how awesome their divorce was? I haven’t, and suspect nobody else has either. What if you were willing to come to the table and civilly hash out the most appropriate divorce settlement for each other and your family? Just picture the possibility of not only a smoother divorce, but also a quicker and cheaper divorce too.

Secret #2 – Work with the right Professionals

If you are considering a large financial purchase or life change like retirement, it is not uncommon to hear, “hey, you should talk to my financial advisor.” So why is it that when someone mentions divorce, which requires huge financial decisions, does everyone ask if you have called a lawyer? Don’t get me wrong, attorneys are great and necessary in a lot of cases, but why wouldn’t you first call a financial expert? A Certified Divorce Financial Analyst® (CDFA®) can help to educate you and guide you through this large and complicated financial decision. A lawyer can direct you and provide legal counsel, but a CDFA® can help you understand what your divorce settlement looks like today, as well as projecting it out in the future. If you want the outcome mentioned above be cautious of the combative attorneys and consider a CDFA® to be a part of your team.

Secret #3 – Prepare Emotionally

Divorce is scary, emotionally draining, confusing, overwhelming, and the list goes on and on. Nobody expects you to check your emotions at the door; it’s okay to feel the emotions of divorce. What you need to be aware of is allowing those emotions to become all consuming. This could lead to an inability to make decisions or making too many emotionally driven decisions. If you are not working with a counselor or licensed therapist, you should be. Emotional healing must start with looking inside yourself first. If you are seeking a successful divorce that can ultimately lead to a healthier and happier post-divorce, then you must be willing to examine your own life.

So, what is the formula for a successful divorce? I believe it starts with a willingness to work together, something that may be very difficult to do, but necessary to save money and save each other from more pain and heartache. Then it’s contacting the right professionals who can work with you to settle without paying an arm and a leg. If you want to learn more about what this might look like, please contact Next Step Divorce Solutions.

Five Common Mistakes Made in Divorce

There are a lot of mistakes that can be made throughout a divorce, but there are some that can be felt for years beyond the final divorce decree.

Avoiding the Financial Homework

It is typical that one spouse handles the finances. As you enter negotiations on a divorce settlement the family financial manager will have a leg up. If you believe you are heading into divorce or have recently been served papers and you are not the financial person in your marriage, it is time to become one. You can work with a Certified Divorce Financial Analyst® to help guide you through the items to begin collecting, but you need to go beyond collecting the data. You are embarking on a journey that will require you to begin making big financial decisions and you must start learning what you have and how to manage it. Working with an advisor is a good starting place but don’t expect to pass the responsibility over, they are there to guide and direct you. This may seem daunting, but you are capable, it starts by taking one step at a time.

Hiring a combative attorney

Hiring the right professionals in a divorce case can get very expensive, especially if you end up heading to court. According to Martindale-Nolo Research the average cost of divorce in Texas is just under $16,000 and on average will last a year. If you end up having to go to court to settle your divorce, those figures could nearly double. You will save yourself a significant amount of resources and time by choosing to work together, with some guidance, and mediate your case. Not only will this be less costly, but it will also offer you the most flexibility when negotiating your divorce settlement.

Making emotional decisions

Divorce is emotional, nobody is arguing that fact. When it comes to splitting assets, I would caution you to not get focused on any one asset; the house, paintings, pension, etc. Lean on your Certified Divorce Financial Analyst® to help you get a look at the bigger picture. This is commonly seen with the family home, especially if children are involved. The main caregiver, in most cases the women, may not want to cause more emotional distress on the kids so she fights to keep a house she can’t afford. She becomes house poor and after years of being a stay at home mom, she is now having to go back to work or ultimately sell the house she fought so hard to keep. Making emotional decisions may satisfy a short-term desire but it may have long lasting negative impact on the financial health of the “losing” party.

Not considering taxes

The U.S. tax code is complicated and doesn’t seem to ever simplify. Whenever any financial decision is made about buying, selling, splitting, holding, inheriting, and the list goes on, you must consider the tax impact. Why? The most obvious is the rates alone. Let’s say for example that a couple has a checking account and two IRA accounts. In an effort to make an equitable split one might suggest that one spouse keep the checking account and the other take the two IRA’s that in value equal the same as the checking account. Great, equitable split, right? No! Whenever you take money out of an IRA it is like receiving a paycheck for tax purposes, so depending on the amount you take out you will pay ordinary income tax which today could be as high as 39.6%. Let’s suppose this couple is in their early 50s, now you have to tack on an additional 10% tax penalty for withdrawing the funds from an IRA prior to age 59 ½. Still think this is an even split? I caution you not to make decisions based solely on tax ramifications, but to not consider them at all is a huge mistake.

Not Implementing the divorce

You have a final divorce decree, now what. Now the work begins to unravel marital assets, so you can begin to pick up the pieces and move forward. What does that entail? Changing account titles, getting a Qualified Domestic Relations Order (QDRO) for your ERISA plans that will be split, and then actually following through to process it with the institution. Updating your estate documents; you may not want your ex-spouse being named as your power of attorney or receiving assets through your Will. And don’t forget about those beneficiary designations too! Your financial advisor can help with this process and then work with you to redefine your objectives and goals to rebuild your financial plan.

For guidance on avoiding these mistakes please contact a Certified Divorce Financial Analyst®. This is the post content

- 1

- 2